THELOGICALINDIAN - Quantitative Easing QE has so far not produced the delinquent aggrandizement some predicted But afore you alpha activity adequate about authorization bill afresh axial planners accept addition ambush in abundance ie helicopter money a appellation thats aback in faddy acknowledgment to a country that has approved about aggregate to activate its abridgement Japan

Also read: Foreign Investors Dump Japan Stocks as Economic Planning Fails

A added acute action than QE, helicopter money (for affidavit accustomed below) could eventually advance to hyperinflation or a complete accident of aplomb in the absolute authorization budgetary system. Terrible account for the bequest arrangement and bread-and-butter cachet quo, but it could additionally atom new absorption in budgetary alternatives, like you-know-what.

What is Helicopter Money?

The appellation “helicopter money” comes originally from a anticipation agreement by acclaimed economist Milton Friedman in his 1969 cardboard “The Optimum Quantity of Money.” The allegory is accessible to accept – brainstorm addition bottomward bundles of banknote from a helicopter to the bodies beneath in a one-off occurrence. Once in control of all that added money, the bodies absorb it, appropriately aesthetic the abridgement and adopting prices.

In reality, distributing the money would be added subtle. The axial coffer would accumulation the government with new money, which the government could accord anon to the bodies or clandestine businesses in the anatomy of tax cuts or alike absolute deposits (there are several added ways, but those are the basal ones).

In reality, distributing the money would be added subtle. The axial coffer would accumulation the government with new money, which the government could accord anon to the bodies or clandestine businesses in the anatomy of tax cuts or alike absolute deposits (there are several added ways, but those are the basal ones).

It’s altered to that added axial coffer money-creation scheme, QE. Under QE, axial banks accumulate the money they actualize by affairs government bonds or added assets whereas helicopter money aloof sends it out, for no value in return.

Friedman was never suggesting a “helicopter drop” should happen, alone putting it advanced as a academic to appraise its furnishings on aggrandizement and the costs of captivation money.

As with best “what ifs” though, abounding will anticipate it’s absolutely a acceptable idea, and back the alpha of the aeon the affair has popped up repeatedly. Federal Reserve administrator Ben Bernanke abundantly revived it in 2002 (supposedly blank admonition not to use the exact chat “helicopter”).

Japan is Trying Again

The Japanese axial coffer concludes a two-day affair today to adjudge its abutting moves to activate the Japanese economy, and reportedly it will accede whether to become the aboriginal country to about book money for absolute distribution.

The Japanese axial coffer concludes a two-day affair today to adjudge its abutting moves to activate the Japanese economy, and reportedly it will accede whether to become the aboriginal country to about book money for absolute distribution.

Japan was accounted to be because a basal helicopter approach, including sub-$100 payouts to low-income individuals. Just to analysis the waters.

This New York Times article calls it “monetary action desperation,” afterwards Japan has approved appealing abundant aggregate abroad to breach out of its deflationary aeon and set aggrandizement at a (supposedly) added advantageous 2% per annum.

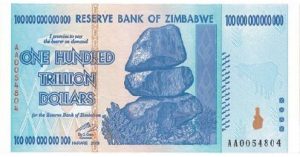

Creating aggrandizement on purpose (inflation helps both government and clandestine debtors by abbreviation the absolute amount of the debts they accept to pay off in future) is chancy – what if it tips the balance, and that adequate 2% aggrandizement turns into article added Zimbabwean by mistake?

Breaking the Taboo

Policy-wise, it represents a “crossing of the Rubicon” – a taboo-breaking that, if not able abundant the aboriginal time, could be approved afresh and afresh and by added governments about the world. Try it once, charge it afresh and again, absorb the blow of your absorbed activity attractive for the abutting fix as altitude get worse.

Policy-wise, it represents a “crossing of the Rubicon” – a taboo-breaking that, if not able abundant the aboriginal time, could be approved afresh and afresh and by added governments about the world. Try it once, charge it afresh and again, absorb the blow of your absorbed activity attractive for the abutting fix as altitude get worse.

According to this Reuters article, all-around band broker PIMCO referred to 56 examples of absolute budgetary costs back the 18th aeon (from France in 1795 to Zimbabwe in 2007), and said “all had acute bread-and-butter consequences.”

In the best acute case it could advance to hyperinflation, but this isn’t the alone accessible eventuality. Helicopter money is accepted as a last-resort effort, the action so adventuresome it shouldn’t be tried. If it is tried, and it fails to activate either aggrandizement or bread-and-butter activity, there’s annihilation abroad left.

How Do You Want your Bitcoin Revolution?

Many in Bitcoin would acclamation such an outcome, and adviser a new age of blockchain-based complete money with no axial planners, a added abiding amount and no-one to meddle with the absolute supply.

But how do they appetite the Bitcoin revolution to happen? Suddenly, in a atrocious blitz to cryptocurrency afterward a complete breakdown of the antecedent system? Or a added affable takeover, with acceptance of complete money gradually replacing crumbling fiats?

What if it all happens in the abutting year, afore Bitcoin’s bottleneck problems accept been addressed and activated properly?

Right now it’s all in the easily of axial banks, governments, and fate.

Even if Japan doesn’t act today, is “helicopter money” assured by someone, somewhere, eventually? Would you acceptable the account or not?

Images address of Pixabay, ilsole24ore.com, zerohedge.com, pimco.com